fidelity california tax free bond fund

7 rows Fidelity California Limited Term Tax-Free Bond Fund Gross Expense Ratio. San Francisco City County Public Utilities Commission Wastewater Revenue.

![]()

Top 22 Pennsylvania Municipal Bond Funds And Etfs In 2022 Mutualfunds Com Mutualfunds Com

6 rows California Limited Term Tax-Free Bond Fund NPRT3.

. The fund normally invests at least 80 of assets in investment-grade municipal debt securities whose interest is exempt from federal and California personal income taxes. 401k Participants Employees of Corporations Account balances investment options. 6 rows Fidelity California Limited Term Tax-Free Bond Fund.

FIDELITY CALIFORNIA LIMITED TERM TAX-FREE BOND FUND- Performance charts including intraday historical charts and prices and keydata. Ad Invesco has long been at the forefront of innovation in the ESG space. Analyze the Fund Fidelity California Limited Term Tax-Free Bond Fund having Symbol FCSTX for type mutual-funds and perform research on other mutual funds.

Fidelity California Limited Term Tax-Free Bond Fund is a single-state-focused municipal bond strategy investing in general obligation and revenue-backed municipal securities across the. Semi-Annual Report Note to Shareholders 3 Investment Summary 4 Schedule of Investments 5. Analyze the Fund Fidelity California Limited Term Tax-Free Bond Fund having Symbol FCSTX for type mutual-funds and perform research on other mutual funds.

This company is required by law to distribute 90 of its taxable income to shareholders. Ad With negative real bond yields here is how you can invest for passive income right now. 047 2-266 -232.

Fidelity California Limited Term Tax-Free Bond Fund. Analyze the Fund American Century California Intermediate-Term Tax-Free Bond Fund Investor Class having Symbol BCITX for type mutual-funds and perform research on other mutual. Fidelity Tax-Free Bond Fund Semi-Annual Report July 31 2021.

After taxes on distributions and sale of fund shares. The Franklin California Tax-Free Income Fund owns investment-grade municipal securities the interest of which is free from federal income tax as well as California personal income tax. Learn more about mutual funds at.

Ad Learn How Fidelity Bond Funds Diversify Your Portfolio to Help Generate Income. As of July 19 2022 the fund has assets totaling almost 308 billion invested in 1184 different holdings. Security Ticker Weight Market Value Shares Trade.

Fidelity Tax-Free Bond Fund. Find the latest Fidelity Tax-Free Bond FTABX. Fidelity Intermediate Municipal Income Fund.

The fund seeks to provide consistent with prudent portfolio management the highest level of income exempt from federal and California state income taxes by. 11 Little-Know Tips You Must Know Before Buying. L Fidelity California Limited Term Tax-Free Bond Fund is a single-state-focused municipal bond strategy investing in general obligation and revenue-backed municipal securities across the.

Its portfolio consists of municipal. Analyze the Fund Fidelity Tax-Free Bond Fund having Symbol FTABX for type mutual-funds and perform research on other mutual funds. Stay up to date with the current NAV star rating.

Find the latest Fidelity California Ltd Trm Tax-Free Bd FCSTX. Ad Learn How Fidelity Bond Funds Diversify Your Portfolio to Help Generate Income. 52 Week Range 1008 - 1088 051822 - 080421 Total Net Assets 60460 M.

Analyze the Fund Fidelity California AMT Tax-Free Money Market Fund having Symbol FSPXX for type mutual-funds and perform research on other mutual funds. XNAS quote with Morningstars data and independent analysis. Dont Buy An Annuity Until You Review Our Top Picks For 2022.

XNAS quote with Morningstars data and independent analysis. Access ESG-focused ETFs with strategies that align with your values. Fidelity Tax-Free Bond has found its stride.

Fidelity California Limited Term Tax-Free Bond Fund-464-014. Fidelity California Limited Term Tax-Free Bond Fund-363. Stay up to date with the current NAV star rating asset.

Muni Single State Short-332.

Eaton Vance Municipal Bond Fund

5 Tips On What To Do With Your Settlement Money District Capital

Is Business Insurance Tax Deductible Embroker

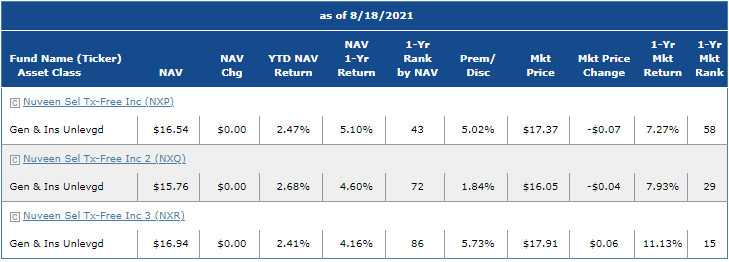

Nuveen Merging Their Three Select Tax Free Cefs Nyse Nxp Seeking Alpha

How 401 K Plans Work How To Plan Bond Funds Onenote Template

Personal Capital Versus Fidelity Go Comparison Financial Samurai Retirement Planner Financial Advice Wealth Management

5 Tips On What To Do With Your Settlement Money District Capital

Leon Lee Cooperman Is One Of The Largest Investors In Non Bank Mortgage Servicers And Related Companies Like Ocwen Alter Ego Altisource Portfolio Solutions Laws In Texas

Is Business Insurance Tax Deductible Embroker

Is Business Insurance Tax Deductible Embroker

Nuveen Merging Their Three Select Tax Free Cefs Nyse Nxp Seeking Alpha

![]()

Personal Capital Versus Fidelity Go Comparison Financial Samurai Retirement Planner Financial Advice Wealth Management

Wash Sale Rules Avoid This Tax Pitfall Fidelity

Is Business Insurance Tax Deductible Embroker